The #1 Guide to Sell Inherited Land in Arkansas

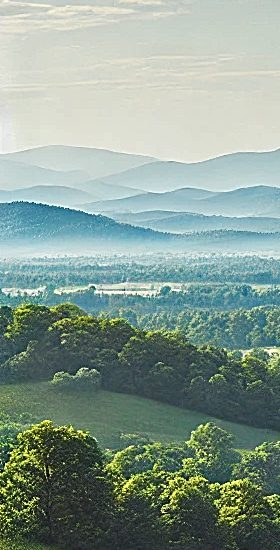

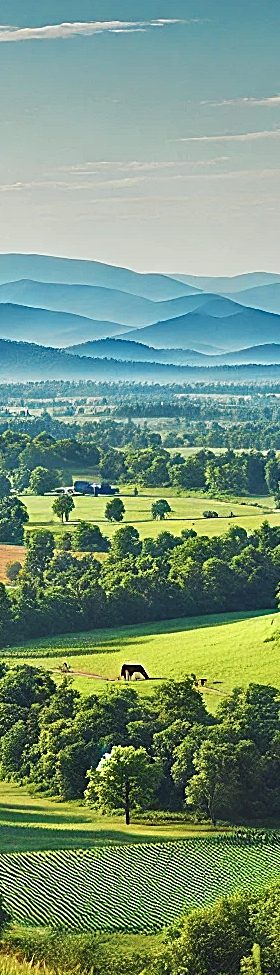

Selling inherited land in Arkansas can feel a bit like stumbling upon a treasure chest—exciting at first, but soon enough, you realize there are a few locks to pick before you can fully enjoy the spoils. Whether it’s a sprawling patch of the Arkansas Delta, a cozy slice of the Ozarks, or land just a stone’s throw from Little Rock, inheriting land here can be both sentimental and financially rewarding.

With Arkansas farmland prices averaging around $3,700 per acre in 2023, there’s plenty of opportunity for turning that inherited land into a solid financial win. But, much like navigating the twists and turns of the Buffalo River, there’s a process to follow. Between taxes, legal paperwork, and decisions about whether to hold or sell, you’ve got some steps to take. Fear not, this guide is here to help make the journey a little less rocky and a lot more rewarding!

How to Sell Inherited Property in AR

Selling inherited land in Arkansas comes with its own set of challenges and benefits, much like any state. However, Arkansas is unique due to its large swathes of rural land, especially in regions like the Delta and Ozarks. With farmland in Arkansas averaging around $3,700 per acre as of 2023, the state’s affordability compared to neighboring areas like Tennessee or Texas makes it an attractive option for investors.

Moreover, Arkansas’s natural resources, including timber and mineral rights, can add extra value to inherited land. A large percentage of the state’s land is used for timber production, which accounted for nearly 50% of its forest cover. If your property includes timber rights, it could significantly increase its appeal to buyers.

1. Gather the Necessary Documents

In Arkansas, making sure all your paperwork is in order before listing your land is critical, especially given that 67% of rural land in the state is privately owned, often passed down through generations. Missing a single key document, like a property title or proof of inheritance, can delay the sale by months. Thankfully, most counties in Arkansas, including Pulaski and Washington, offer online access to property records, making it easier for you to gather essential documents like titles and tax records.

One key difference in Arkansas is the prevalence of mineral rights. If your inherited land includes mineral resources, you’ll want to confirm who owns these rights. They can either be sold with the land or separately, depending on your needs and the buyer’s interest.

2. Secure Legal Ownership of Your Land

Unlike some states, where probate can drag on, Arkansas probate laws allow for a more streamlined process, especially for smaller estates. Properties valued under $100,000 may be eligible for a Small Estate Affidavit, which allows heirs to skip the lengthy probate process altogether. However, securing legal ownership of your land, especially if it involves multiple heirs, can still be a tricky process.

A notable point is that Arkansas has a history of “heir property,” where land is passed down without a clear title, often causing ownership disputes. This is especially common in rural areas. If your family land has been in dispute, consulting with a local real estate attorney can help clear up ownership before you put it on the market.

3. Pay Off Any Unpaid Property Taxes

While Arkansas doesn’t have the sky-high property taxes of some states, it’s still important to clear any debts before selling. The average property tax rate in Arkansas sits around 0.61% of the property’s value, making it one of the lower rates in the country. However, if the previous owner fell behind on taxes, those unpaid amounts could slow down the sale process.

Arkansas law requires that delinquent property taxes must be paid before any sale can proceed. In some cases, if taxes go unpaid for three years, the property could be sold at an Arkansas tax auction, which is something you’d definitely want to avoid.

4. Clear Any Existing Liens on the Property

Liens on inherited land can range from unpaid mortgages to mechanic’s liens for work done on the property, all of which must be settled before selling. In Arkansas, it’s common for liens to pop up in unexpected places, especially if the property has been in the family for years without regular upkeep or oversight.

A key Arkansas-specific issue is timber rights liens, where land used for timber production may have liens tied to past sales or unpaid contracts. Clearing these liens early can prevent delays and give potential buyers more confidence in the property’s value. Here’s what to look out for:

- Mortgage Liens: Any outstanding balance on a loan taken out against the land must be repaid.

- Mechanic’s Liens: These result from unpaid contractor fees for work done on the property.

- Tax Liens: Unpaid property taxes could result in liens that need to be cleared before any sale can proceed.

5. Find a Reputable Buyer

One thing that sets Arkansas apart from other states is its abundance of rural land and natural beauty, making it highly appealing to both recreational buyers and those looking to invest in agriculture. Depending on where your property is located—whether it’s tucked away in the Ozarks or positioned along the fertile Arkansas Delta—the buyer market will vary.

In 2022, Arkansas saw a 15% increase in land sales, with buyers particularly interested in farmland and timberland. Additionally, Arkansas is a hotspot for hunting land buyers due to its rich wildlife, which includes deer, turkey, and waterfowl. This creates a niche market for inherited land that can be marketed to outdoor enthusiasts. Depending on your goals, here are some options:

- Real Estate Agent: A local real estate pro will have the expertise and connections to find the right buyers, market your land effectively, and handle the legal stuff so you don’t have to sweat it.

- Sell by Owner (FSBO): If you’re confident in your ability to manage the sale, listing the land yourself could save you on commission fees. Just be ready for some extra legwork when it comes to negotiating and paperwork.

- Land Buying Companies: If you want a no-hassle, quick sale, companies that specialize in buying land, like Bubba Land Company or similar, can be a great option. They often make cash offers and help speed up the process, letting you avoid the complexities of the traditional sale route.

| Selling Land with an Agent | Selling Land Yourself (FSBO) | Selling to Bubba Land | |

|---|---|---|---|

| Commissions / Fees | If they even accept the listing, it’s typically 10% Commission on the Sales Price for Specialized Land Agents. | Flat-Rate MLS fees, Specialized Land Selling Website fees, & Marketing Fees. Minimum $1,000 in Fees. | $0 Fees: No Commissions or Hidden Costs. |

| Average Days Until Sold | Typically 6 months, depending on the Asking Price. If priced too high you could be waiting years! | Typically 12 months for FSBO, depending on the Asking Price. If priced too high you could be waiting years! | Less than 48 Hours: we can Get You an Offer! |

| Number of Showings | Depends on Asking Price & Agent’s Motivation. The higher the price, the longer it’ll take to sell. | Typically less showings than working with an Agent. Online Platforms outside the MLS attract less buyers. | None: No Showings Required. |

| Who Pays Closing Costs? | Seller typically pays $2,000 minimum for Closing Costs, plus 10% to the Sales Agent. | Seller typically pays $2,000 minimum for Closing Costs. | None: We Cover All Costs! |

| Closing Date | Typically 45-90 days after accepting an offer. | Typically 45-90 days after accepting an offer. | ASAP: You Pick the Date! |

| Costs for Land Improvements | Varies depending on the condition and marketability of the land. | Depends on what’s needed to make the land attractive for sale. | None: We Buy As-Is! |

Will I Need to Go Through Probate to Sell My Inherited Land?

Probate in Arkansas is necessary if the deceased owner did not set up a living trust or have a co-owner with rights of survivorship. The process generally takes 6-9 months but can vary depending on the complexity of the estate. One perk of Arkansas probate law is that smaller estates—valued under $100,000—may qualify for a streamlined process through a Small Estate Affidavit.

While this speeds things up, larger estates will still need to go through the full probate process. For Arkansas property that includes mineral or timber rights, probate can take a bit longer, as these assets require additional valuation and legal verification.

1. Get Professional Guidance

If you’re unsure whether your inherited land in Arkansas needs to go through probate, consulting with a probate attorney is a smart first step. The rules in Arkansas are slightly different compared to other states, and a local expert can help determine whether the property can bypass probate or needs a more formal approach. In fact, Arkansas attorneys often specialize in rural land inheritance due to the complexity of land rights in areas with timber and mineral resources.

2. Determine If Probate Is Necessary

In Arkansas, not all estates need to go through probate, especially if the property was held in joint tenancy or trusts. If the estate qualifies for summary probate, a simplified version of the process, it can be resolved in a matter of months rather than a year or more. This is particularly helpful if you need to sell the land quickly.

3. Begin the Probate Process (If Required)

If probate is necessary, it begins with validating the will and appointing an executor. In Arkansas, the executor will work with the county court to oversee the process, which typically includes paying off debts and distributing the estate’s assets. For larger, more complex estates involving timber or mineral rights, probate could stretch longer.

4. Address Property-Related Financial Matters

Unpaid property taxes and bills tied to the land must be addressed during the probate process in Arkansas. If there’s a mortgage on the property, payments need to continue while probate is underway, or risk complications during the sale. It’s also essential to stay on top of bills like utilities, insurance, and property upkeep to ensure the land remains attractive to potential buyers.

5. Plan for Inheritance & Capital Gains Taxes

Arkansas doesn’t have a state inheritance tax, but you may still face federal estate taxes depending on the value of the inherited property. In addition, when you sell inherited property, you could be hit with capital gains taxes if the sale price exceeds the property’s stepped-up tax basis—which is the value at the time of the previous owner’s death. However, Arkansas’s relatively low land prices often mean you can minimize capital gains compared to higher-value states like California or Florida.

6. Finalizing the Sale

With probate complete and all financial matters squared away, you can finalize the sale of your inherited land in Arkansas. Depending on where your land is located, you could market it to buyers interested in recreational use, timber production, or agricultural purposes. If your property has mineral rights or is rich in natural resources, it may attract additional interest from companies in the timber or natural gas sectors.

Partnering with Bubba Land for Seamless Land Transactions

Buying or selling land can be a daunting task, laden with complex legal processes and extensive paperwork. At Bubba Land, we understand that your time is valuable, and our goal is to make your land transactions as smooth and stress-free as possible. By partnering with a professional land company like ours, you can avoid the pitfalls and costly mistakes that often come with navigating land deals on your own.

- No Realtor Fees or Closing Costs: Sell directly to Bubba Land and keep more money in your pocket.

- Hassle-Free Process: Skip the marketing and showings; we make direct offers for a quick sale.

- Fast Cash Offers: Get paid quickly, without the long wait.

- Straightforward Transaction: No complicated negotiations—just a simple, direct sale.

- Reduce Risk: Sell quickly to avoid long listing periods and potential property issues.

In the land business, it’s important to partner with a company that has a proven track record and a commitment to integrity. Bubba Land is dedicated to providing you with a seamless, hassle-free experience, and we pride ourselves on being a trustworthy partner in your land journey. Whether you’re looking to sell quickly for cash or need assistance navigating a complex land purchase, we’re here to help.

Conclusion on Selling Inherited Land in Arkansas

Selling inherited land in Arkansas might feel like a complex journey, but with the right approach, it can turn into a smooth ride—and a profitable one at that. Whether you’re working through probate, tracking down documents, or negotiating with buyers, having a clear plan in place will make all the difference. Arkansas offers a unique landscape of opportunities, from farmland to timber rights, so it’s essential to position your land correctly to attract the best offers.

Remember, there’s no one-size-fits-all approach when it comes to selling inherited property. Whether you’re looking for a quick sale with a land-buying company or prefer a more traditional route with a real estate agent, take the time to explore your options. And don’t forget about the unique benefits Arkansas offers, like its affordable land prices, natural resources, and thriving market for recreational land. With the right strategy, you can honor the legacy of your inherited land while securing a bright financial future for yourself.

Frequently Asked Questions (FAQs)

1. Do I Need to Go Through Probate to Sell Inherited Land in Arkansas?

Yes, in most cases, probate is required to establish legal ownership before you can sell inherited land in Arkansas. If the land was part of a trust or had a co-owner with rights of survivorship, you might be able to avoid probate. For smaller estates, Arkansas offers a streamlined Small Estate Affidavit process, which could simplify the sale.

2. What Taxes Do I Need to Pay When Selling Inherited Land in Arkansas?

When you sell inherited land, you may be subject to capital gains tax. The taxable amount is based on the difference between the sale price and the land’s stepped-up basis, which is its value at the time of inheritance. Arkansas does not have an inheritance tax, but federal estate taxes may apply to larger estates.

3. How Do I Determine the Value of Inherited Land in Arkansas?

To determine the land’s value, it’s best to get a professional appraisal shortly after inheritance. This establishes the stepped-up basis for tax purposes. Additionally, you can consult local real estate experts who understand Arkansas’s market, particularly for farmland or rural properties, to gauge its current market value.

4. Can I Sell Inherited Land if There Are Multiple Heirs in Arkansas?

Yes, you can sell inherited land with multiple heirs, but all heirs must typically agree to the sale. If disagreements arise, you may need to file a partition action to force the sale. However, it’s usually best to reach a consensus to avoid legal complications and preserve family relationships.

5. How Quickly Can I Sell Inherited Land in Arkansas?

The timeline for selling inherited land in Arkansas depends on several factors, such as clearing probate, resolving any liens, and preparing the property for sale. If you’re looking for a quicker sale, selling to a land-buying company can help expedite the process, often closing in 30 days or less. Otherwise, using a real estate agent to market the property could take several months.