The #1 Guide to Sell Inherited Land in South Carolina

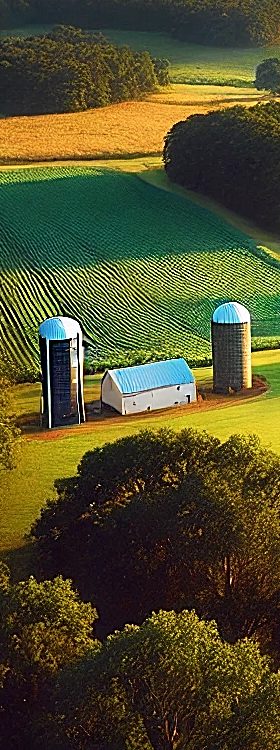

Inheriting land in South Carolina can be a mix of excitement and uncertainty. Whether you’ve come into possession of a coastal retreat, a charming plot in the countryside, or just some good ol’ family farmland, there’s real value to be found in your inherited property. South Carolina, with its average land price hovering around $7,000 per acre, offers some of the most prized real estate in the Southeast. In fact, South Carolina sees a significant number of inherited properties pass through generations, with over 4.7 million acres of farmland still actively in use across the state.

But as with anything handed down through the family tree, there are responsibilities attached. From legal ownership verification to property taxes and deciding what to do with the land, this guide walks you through it all. Let’s dig into the process of selling inherited land in South Carolina—and maybe turn that family legacy into a future opportunity for you!

How to Sell Inherited Property in SC

Selling inherited land in South Carolina is like stepping into a whole new world of real estate—one filled with a mix of family history, legal red tape, and the occasional relative popping up to claim their “fair share.” It’s a little more complicated than just putting a “For Sale” sign in the yard of a house you’ve lived in for years. You’re not just managing a sale—you’re navigating emotions, handling legalities, and maybe even sorting out multiple heirs.

The good news? You don’t have to do it alone. I’m here to walk you through the whole process. South Carolina consistently ranks in the top 15 states for inherited rural property transfers. Let’s break it down and get you from inherited land to something that works for you—whether it’s cash, a future investment, or passing it on to the next generation.

1. Gather the Necessary Documents

First things first: paperwork. South Carolina might not go easy on you when it comes to documentation, so having everything in order is crucial to avoid delays. Unlike some states where probate can be more lenient, South Carolina requires a pretty buttoned-up process. Here’s what you need:

- Proof of Inheritance: This could be a will, probate paperwork, or a letter of administration proving you’re the rightful owner.

- Property Title: If the title is nowhere to be found, don’t worry—just swing by the county courthouse and get a copy.

- Tax Records: South Carolina takes property taxes seriously. You’ll want to ensure all taxes are paid up to date.

- Outstanding Liens or Mortgages: Got unpaid debts tied to the land? Now’s the time to check and clear them up to avoid any last-minute surprises.

In South Carolina, probate can be a bit more detailed than in other states, especially if there are multiple heirs. Getting everything together now will save you headaches down the road!

2. Secure Legal Ownership of Your Land

Before you start plotting your next move with the property, make sure the deed reflects you as the legal owner. South Carolina’s land transfer system is pretty straightforward, but each of the 46 counties has its own office where deeds are recorded. You’ll need to get the deed in your name to move forward. If there’s a mix-up, no worries—an estate attorney can help straighten it out.

South Carolina also has a quirky feature: their “life estate deeds,” which allows the property owner to pass the land on while retaining lifetime use. If your inherited property was subject to such an arrangement, you might need a little extra legal help to figure it out.

3. Pay Off Any Unpaid Property Taxes

South Carolina’s got more than beaches and BBQ; it’s also got property taxes. If those haven’t been paid since the previous owner’s passing, you’ll need to settle up before you can sell. With property tax rates varying by county, it’s essential to check with your local tax assessor to avoid any tax liens creeping up.

Delinquent property taxes in South Carolina can result in a tax lien or even the county auctioning off the property. Yikes! To avoid this, handle those payments right away. You might also consider setting up automatic payments, so nothing slips through the cracks in the future. It’s one less hassle to worry about.

4. Clear Any Existing Liens on the Property

You don’t want any baggage tied to your inherited land—especially in the form of debts or liens. In South Carolina, common liens can include unpaid mortgages, contractor fees, or tax liens. Thankfully, you can run a quick search of county records to see if any of these are attached to your property.

Once you’ve identified any liens, you’ll need to reach out to the lienholder and work on a settlement. Depending on the situation, offering proof of inheritance may help smooth the process. Clearing these debts is crucial since South Carolina’s lien laws allow interest to pile up quickly if unpaid.

5. Find a Reputable Buyer

Once the legal issues are sorted out, it’s time to find a buyer. There are several ways you can go about this, depending on your timeline and goals:

- Real Estate Agent: A local real estate agent can help you market the property effectively, handle negotiations, and manage the legal aspects of the sale. They bring expertise, a network of potential buyers, and knowledge of the local market to ensure you get the best possible price.

- Sell By Owner: If you’re confident in your ability to handle the sale yourself and want to avoid agent commissions, you can list the land as a “For Sale By Owner” (FSBO) transaction. This option works best if you’re familiar with real estate contracts and negotiations, but keep in mind it requires more hands-on involvement.

- Sell to a Land Buying Company: For a quick and hassle-free transaction, selling to a land buying company is a great option. Companies like Bubba Land specialize in purchasing land directly, often making cash offers with fewer contingencies. This route is ideal if you’re looking for a fast sale without the complexities of listing and marketing the property.

| Selling Land with an Agent | Selling Land Yourself (FSBO) | Selling to Bubba Land | |

|---|---|---|---|

| Commissions / Fees | If they even accept the listing, it’s typically 10% Commission on the Sales Price for Specialized Land Agents. | Flat-Rate MLS fees, Specialized Land Selling Website fees, & Marketing Fees. Minimum $1,000 in Fees. | $0 Fees: No Commissions or Hidden Costs. |

| Average Days Until Sold | Typically 6 months, depending on the Asking Price. If priced too high you could be waiting years! | Typically 12 months for FSBO, depending on the Asking Price. If priced too high you could be waiting years! | Less than 48 Hours: we can Get You an Offer! |

| Number of Showings | Depends on Asking Price & Agent’s Motivation. The higher the price, the longer it’ll take to sell. | Typically less showings than working with an Agent. Online Platforms outside the MLS attract less buyers. | None: No Showings Required. |

| Who Pays Closing Costs? | Seller typically pays $2,000 minimum for Closing Costs, plus 10% to the Sales Agent. | Seller typically pays $2,000 minimum for Closing Costs. | None: We Cover All Costs! |

| Closing Date | Typically 45-90 days after accepting an offer. | Typically 45-90 days after accepting an offer. | ASAP: You Pick the Date! |

| Costs for Land Improvements | Varies depending on the condition and marketability of the land. | Depends on what’s needed to make the land attractive for sale. | None: We Buy As-Is! |

Will I Need to Go Through Probate to Sell My Inherited Land?

The dreaded probate process is a common part of selling inherited property, but it doesn’t have to feel like a maze. South Carolina has its own set of rules that differ from other states, and understanding those nuances can save you time and stress. Here’s how probate works in the Palmetto State and what makes it stand out.

1. Get Professional Guidance

In South Carolina, the probate process can be more detailed than in some other states. A key difference is the state’s adherence to “strict probate” for most estates, meaning you’ll need to navigate more legal formalities if the estate is larger or involves multiple heirs. It’s essential to consult with an estate attorney who’s familiar with South Carolina’s probate laws, as they’ll guide you through the process and help determine if probate is necessary.

2. Determine If Probate Is Necessary

In South Carolina, probate is generally required when the property wasn’t explicitly left to you in a will or if there are multiple heirs involved. However, the state does offer a simplified probate process for smaller estates valued under $25,000 or if all heirs are in agreement, which can speed things up compared to the full probate process that’s required in other states. If the estate qualifies, your attorney can help fast-track the sale by bypassing some of the more complex legal steps.

3. Begin the Probate Process (If Required)

If probate is required, you’ll need to complete the process before selling the land. What sets South Carolina apart is that its probate courts can be more hands-on when it comes to validating the will, identifying heirs, and ensuring all debts are settled. Depending on the size and complexity of the estate, probate can take anywhere from a few months to over a year. But with the right legal assistance, you can prevent unnecessary delays.

4. Address Property-Related Financial Matters

During the probate process, you’ll need to deal with any outstanding financial obligations tied to the property. This includes paying off any remaining debts, utility bills, or property taxes. In South Carolina, it’s especially important to ensure that property taxes are paid and up to date, as the state’s laws allow counties to place liens or even sell properties for unpaid taxes. Make sure all financial matters are squared away before you proceed with the sale.

5. Plan for Inheritance & Capital Gains Taxes

Inheriting land in South Carolina comes with its share of tax considerations. While the state does not have an inheritance tax, capital gains tax can still apply if you sell the property for more than its appraised value at the time of the original owner’s death. The capital gains tax rate in South Carolina is influenced by both federal and state tax laws, so speaking with your attorney or a tax professional will help you determine how much you might owe when selling the property.

6. Finalizing the Sale

Once probate is complete and all financial matters are settled, it’s time to sell. South Carolina’s probate courts are known for being thorough, so make sure all legal and tax obligations are resolved before putting the land on the market. Whether you sell through a real estate agent, list it yourself as an FSBO (For Sale By Owner), or work with a land-buying company, having all your paperwork in order will make the transaction much smoother.

Partnering with Bubba Land for Seamless Land Transactions

Buying or selling land can be a daunting task, laden with complex legal processes and extensive paperwork. At Bubba Land, we understand that your time is valuable, and our goal is to make your land transactions as smooth and stress-free as possible. By partnering with a professional land company like ours, you can avoid the pitfalls and costly mistakes that often come with navigating land deals on your own.

- No Realtor Fees or Closing Costs: Sell directly to Bubba Land and keep more money in your pocket.

- Hassle-Free Process: Skip the marketing and showings; we make direct offers for a quick sale.

- Fast Cash Offers: Get paid quickly, without the long wait.

- Straightforward Transaction: No complicated negotiations—just a simple, direct sale.

- Reduce Risk: Sell quickly to avoid long listing periods and potential property issues.

In the land business, it’s important to partner with a company that has a proven track record and a commitment to integrity. Bubba Land is dedicated to providing you with a seamless, hassle-free experience, and we pride ourselves on being a trustworthy partner in your land journey. Whether you’re looking to sell quickly for cash or need assistance navigating a complex land purchase, we’re here to help.

Conclusion on Selling Inherited Land in South Carolina

Selling inherited land in South Carolina may seem like a daunting task, but with the right steps and a solid understanding of the probate process, you can turn this inherited asset into an opportunity. South Carolina’s unique laws around probate, taxes, and land ownership make it essential to get all your paperwork in order and seek professional guidance where needed. Whether you choose to sell through a real estate agent, handle the sale yourself, or work with a land-buying company, being prepared will make the journey a lot smoother.

Remember, you’re not just selling a piece of land—you’re potentially closing a chapter on your family’s legacy while opening the door to new possibilities. By taking your time, doing your research, and seeking expert help, you can ensure that the process is as stress-free as possible. Here’s to turning that South Carolina land into something that works for you!

Frequently Asked Questions (FAQs)

1. Do I Have to Go Through Probate to Sell Inherited Land in South Carolina?

Yes, in most cases, you’ll need to go through probate before selling inherited land in South Carolina. Probate ensures that the will is valid, debts are settled, and ownership is transferred correctly. However, for smaller estates or when all heirs agree, South Carolina offers a simplified probate process that can speed things up.

2. How Long Does the Probate Process Take in South Carolina?

The probate timeline in South Carolina can vary depending on the complexity of the estate. For simpler estates, the process may take as little as 6 months, while more complicated estates with multiple heirs or disputes can extend beyond a year. Working with an experienced estate attorney can help streamline the process.

3. What Taxes Will I Have to Pay When Selling Inherited Land in South Carolina?

South Carolina does not have an inheritance tax, but you may owe capital gains tax if you sell the land for more than its value at the time of the original owner’s death. Additionally, you’ll need to ensure all property taxes are paid up to date before the sale to avoid liens or legal complications.

4. Can Multiple Heirs Sell Inherited Property in South Carolina?

Yes, multiple heirs can sell inherited property in South Carolina, but all heirs must agree to the sale. If there is disagreement among heirs, the sale could be delayed or even halted until disputes are resolved. In such cases, working with an attorney can help mediate and ensure a smooth sale.

5. What Are My Options for Selling Inherited Land in South Carolina?

You have several options for selling inherited land in South Carolina. You can work with a local real estate agent who knows the market, sell the land yourself as a For Sale By Owner (FSBO) transaction, or sell directly to a land-buying company for a quick and hassle-free sale. Each option has its pros and cons, depending on your timeline and comfort level.